Cra depreciation calculator

If you purchase a car for 29000 what is the approximate value of the car after 5 years. Car Depreciation Calculator Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

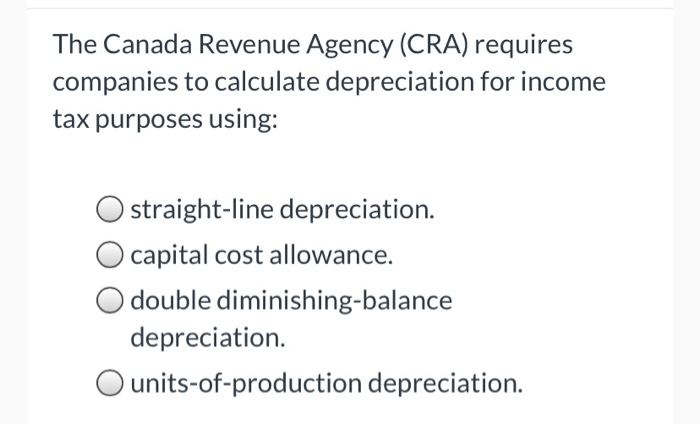

Solved The Canada Revenue Agency Cra Requires Companies To Chegg Com

Ad Estimate Your Monthly Car Loan Payments And See Which Cars Fit Your Budget.

. Let Us Help You Trade-In Your Old Car For A New 2022 Toyota. The recovery period of property is the number of years over which you recover its cost or other basis. It will then depreciate another 15 to 25 each year until it reaches the five.

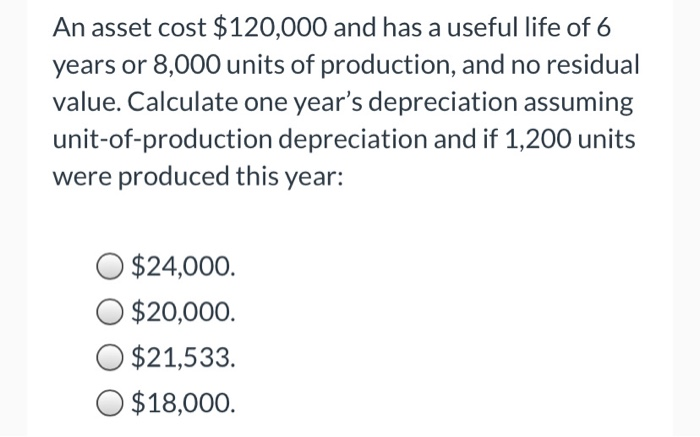

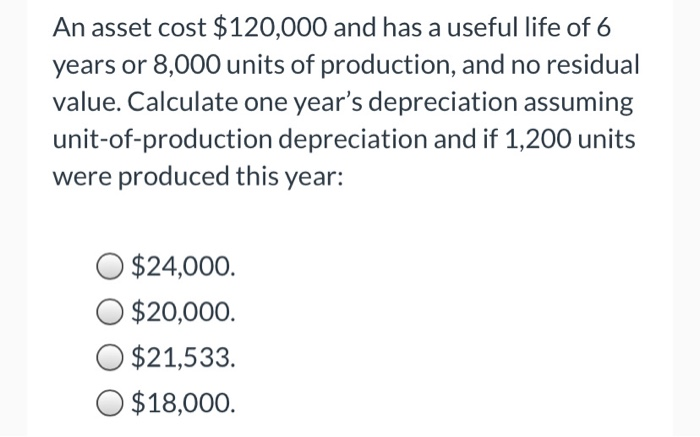

We will even custom tailor the results based upon just a few of. Enter on line 9923 in Area F the. With this method the depreciation is expressed by the total number of units produced vs.

Ad Find Out Your Vehicles Trade-In Value And Upgrade To A New 2022 Toyota. Browse 25000 Cars Get Pre-Qualified To See Your Real Terms For Every Car. Let Us Help You Trade-In Your Old Car For A New 2022 Toyota.

Form T2125 Statement of Business or Professional Activities Area A. Then divide that difference by the original sticker price and. It is determined based on the depreciation system GDS or ADS used.

Average annual value lost 457624. Input Is the car new or used. Ad Find Out Your Vehicles Trade-In Value And Upgrade To A New 2022 Toyota.

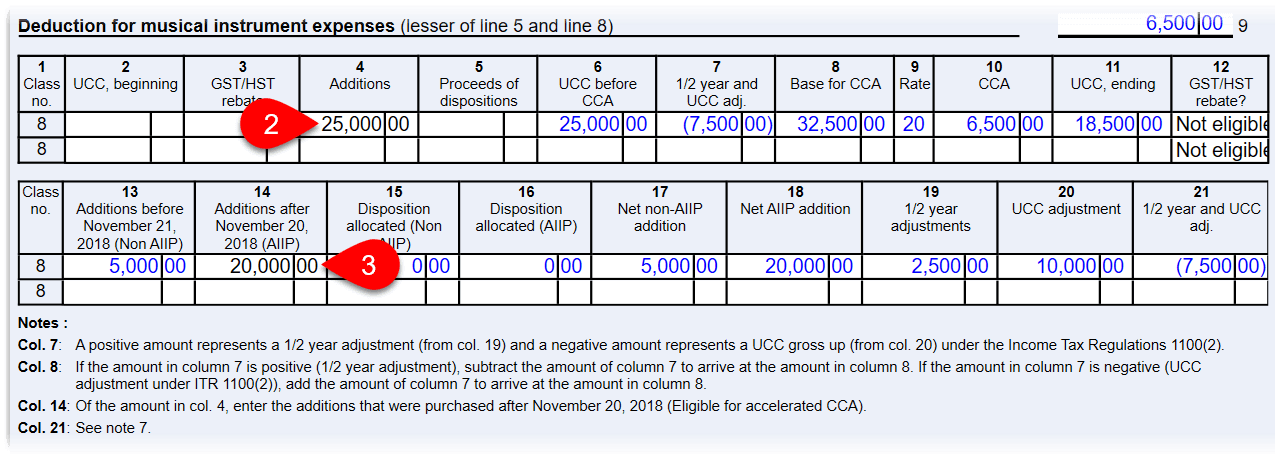

To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. Visit Our Site For More Info. To help calculate your current tax year deduction for CCA and any recaptured CCA as well as terminal losses use.

In fact the cost of your new car drops as soon as you drive it off the dealership lot. Visit Our Site For More Info. Auto depreciation calculator Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years.

The total number of units that the asset can produce. Land is not depreciable property. The average rate of depreciation.

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. We base our estimate on the first 3 year.

Let this calculator help you understand how the value of your car may be affected the longer you drive it. Total depreciation percentage 5717. A car depreciation calculator is an online tool that can be used to calculate the car depreciation rate.

The average car depreciation rate is 14 per year. This new car will lose between 15 and 25 every year after the steep first-year dip. The AutoPadre Car Depreciation Calculator gives you an estimate on how much a car will be worth after a number of years depending on factors such as make model body type.

If you leave the. Depreciation per year Asset Cost - Salvage. Car Depreciation Calculator How much will car depreciation cost you.

AFTER FIVE YEARS. Therefore when you acquire property only include the cost related to the building in Area A and Area C. For example if the pricing of a car is 20000 new and has a resale value of 11000 that is a 9000 difference.

A car depreciation calculator can help you in ascertaining the depreciation borne by your. You can then calculate the depreciation at any stage of your. Calculate Car Depreciation By Make and Model Find the depreciation of your car by selecting your make and model.

Car depreciation refers to the rate at which your car loses its value from the first year you bought it. Non-ACRS Rules Introduces Basic Concepts of Depreciation. P 29000 R 14 n 5 The value of.

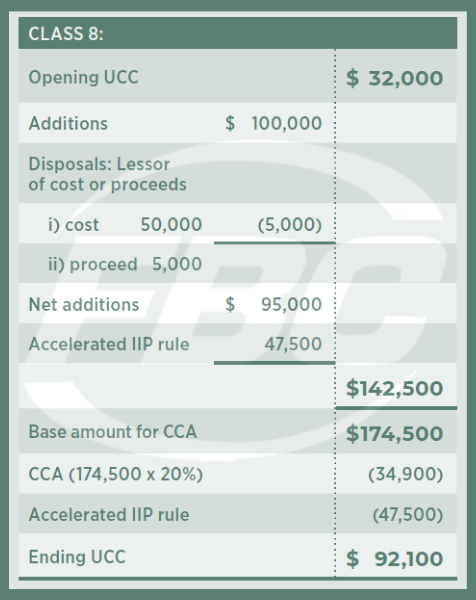

Lesson Three Measuring Income

Solved The Canada Revenue Agency Cra Requires Companies To Chegg Com

Calculating The Capital Cost Allowance Cca Youtube

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

How To Deal With The Cra Rmi Professional Corporation

How And What You Can Claim Your Business Expenses On Your Taxes As A Blogger Canada Save Spend Splurge

Methods Depreciation Guru

Accelerated Cca Taxcycle

Capital Cost Allowance For Farmers Fbc

Methods Depreciation Guru

Capital Cost Allowance Canada Youtube

Freelancer Taxes How To Use The Capital Cost Allowance Rags To Reasonable

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Cca Pptx Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes Cca Is Deducted Before Taxes And Acts As A Tax Shield Every Capital Course Hero

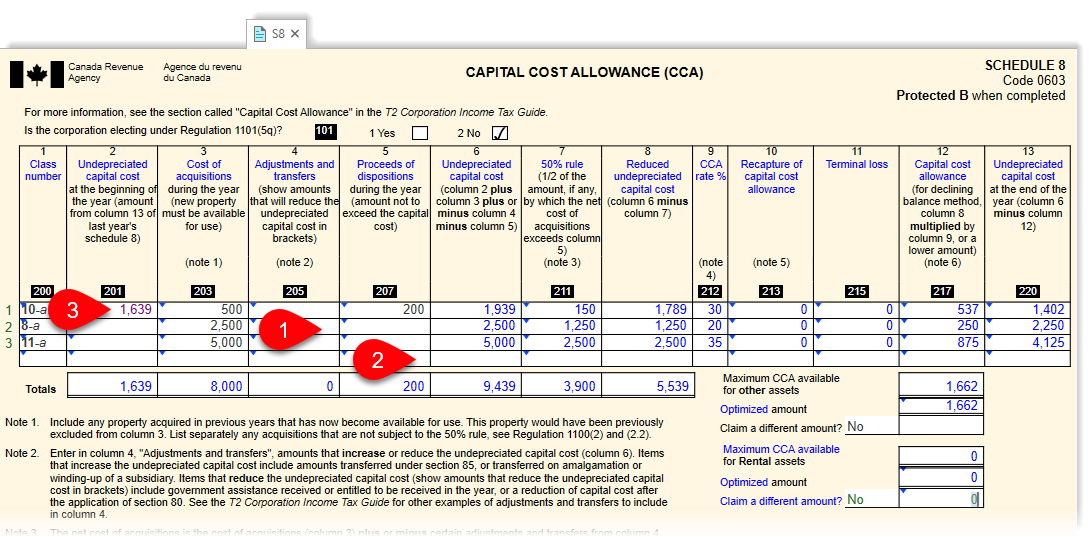

How To Prepare Corporation Income Tax Return For Business In Canada

Schedule 8 Cca And Assets Taxcycle

What Is The Capital Cost Allowance In Canada